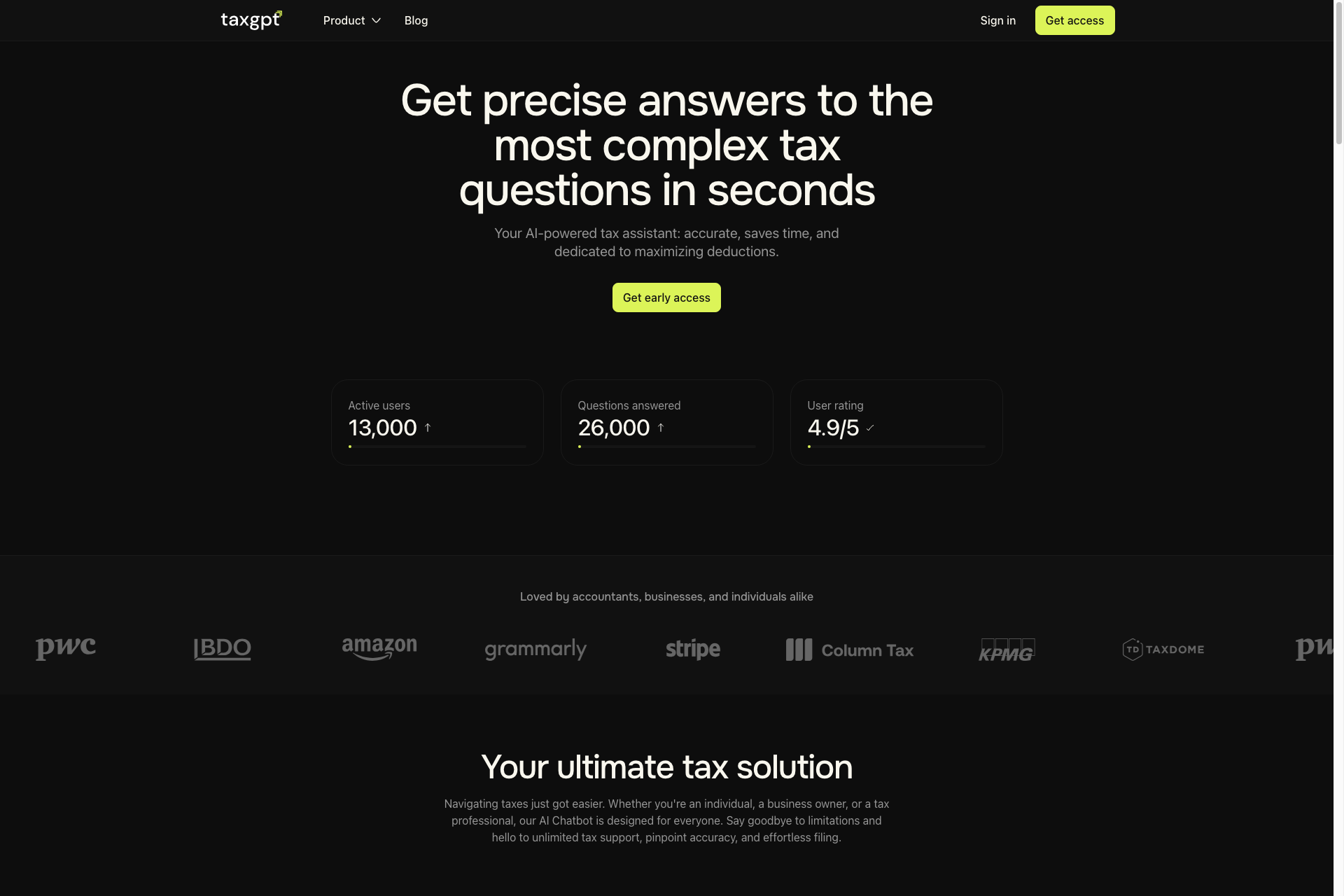

TaxGPT

Introducing TaxGPT: Ask any tax question and get personalized answers. File your taxes effortlessly for only $50, with absolutely no hidden fees. Maximum refund and accuracy guaranteed. Plus, refer friends and earn $5 to $100!

Related Products about TaxGPT

Organize your chats with Gemini, ChatGPT, Codey, and Claude using folders and tags. Use a powerful search engine to find old chats. Share chats and folders with others in your account.

Remodel AI is your own personal AI home designer. Use artificial intelligence to visualize your home remodel in various styles. Take photos of your home and instantly see a fully remodeled version, new flooring, different walls, and more.

A fully automated short form content generator with personalities like Joe Rogan, Jordan Peterson, Obama, and more discussing any topic you desire.

Askible is a Discord bot designed to streamline Q&A on your server. It allows users to ask questions and provides them with direct, accurate answers that you have pre-defined. This user-friendly approach makes information sharing efficient and enhances the overall engagement on your Discord server.

Meet TeleWizard, the world's first AI call center set up in under 5 minutes. Transform your customer support with AI agents that talk like humans, performing actions like ticket creation, record retrieval, and case updates. With 24/7 multilingual support, TeleWizard ensures efficient interactions. It integrates seamlessly with Zendesk, Clio, and Freshdesk for tasks like ticket updates and appointment scheduling. Experience unparalleled customer service with TeleWizard's human-like AI agents. 🌟

An iOS app similar to ChatPDF helps you understand PDF documents through conversations. Perfect for users needing quick insights on one or more documents on mobile devices. It provides excellent support for Chinese and English.