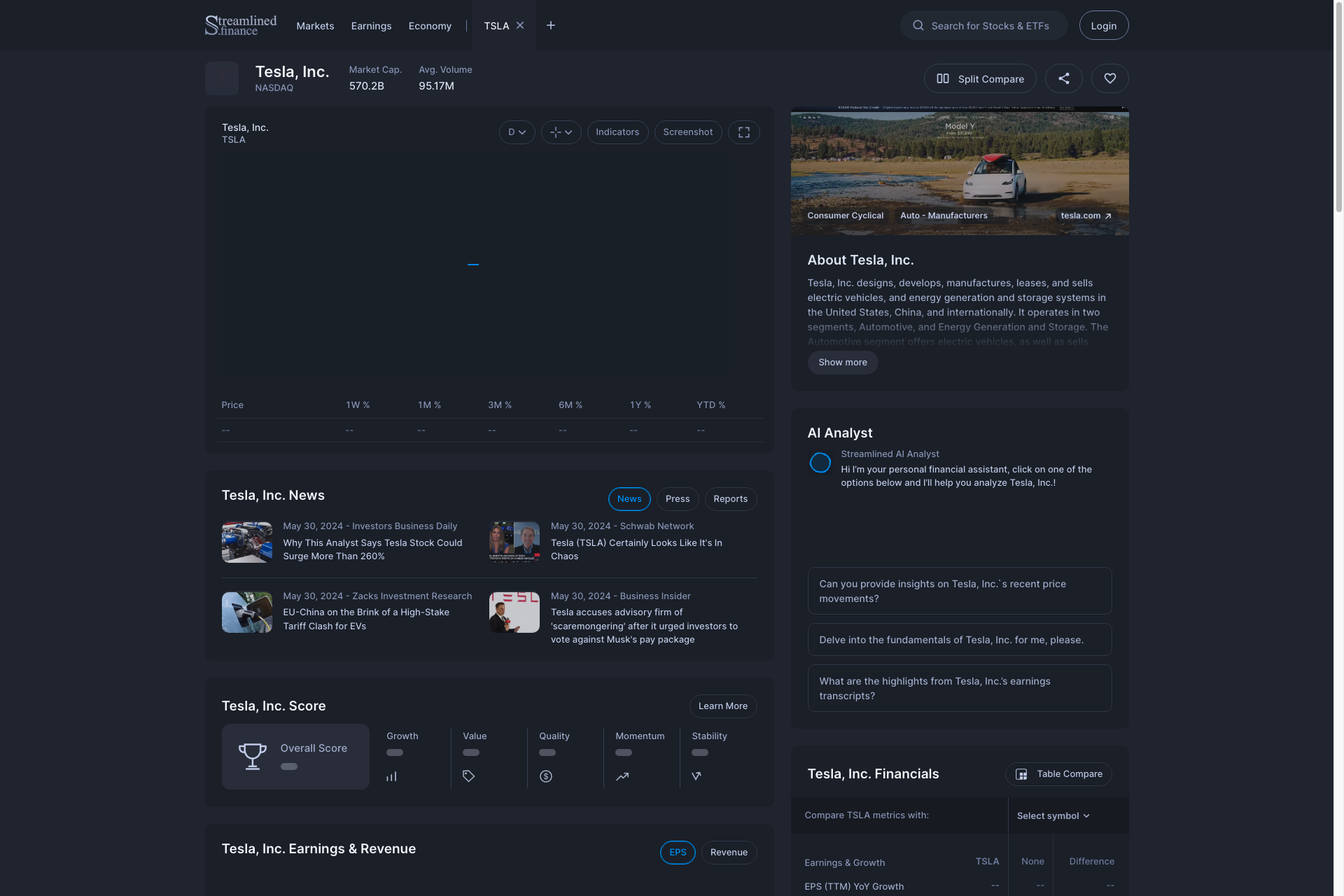

Streamlined AI Stock Analyst

Investment Research the Modern Way: Find the best Stocks to invest in, analyze & compare fundamentals, and start investing confidently.

Related Products about Streamlined AI Stock Analyst

Get your own company website chatbot. A chatbot that services your staff and clients! Integrate into Your Website to Boost Customer Interaction and Sales or Implement In-House for Enhanced Employee Productivity

QuickData Cloud is an intuitive, no-code platform, designed to streamline interaction with Text, Books, CSV, Comments, Database, JSON. It supports effortless storage, management, and retrieval of data via a single API endpoint.

Through generative AI, Permar AI can automatically test texts, images, and entire elements on your website to increase conversion rates. Using performance data, Permar AI iteratively refines the results and helps optimize data-driven eCommerce webshops.

Story.com helps people tell and consume stories. Enter a prompt, get an editable film, book, tiktok, and more. Browse our feed for ideas.

Clippy is back! Access chatGPT using the legendary paperclip on your macOS desktop. Ask anything, have a chat, get help or anything else you need. Clippy lives in the bottom right corner of your screen, so just move your mouse cursor to the corner to chat.

Instant AI Explainers based on Web Results Think Perplexity, but for explaining concepts in simple and short format with related images, videos and recent news items. What would you like to know today?

Struggling with endless email replies? Try ReplyFast! An AI-powered Gmail extension lets you reply 10x faster at only $2.56. Affordable, smart, and easy to integrate with your own OpenAi API. Revolutionize your email experience now!