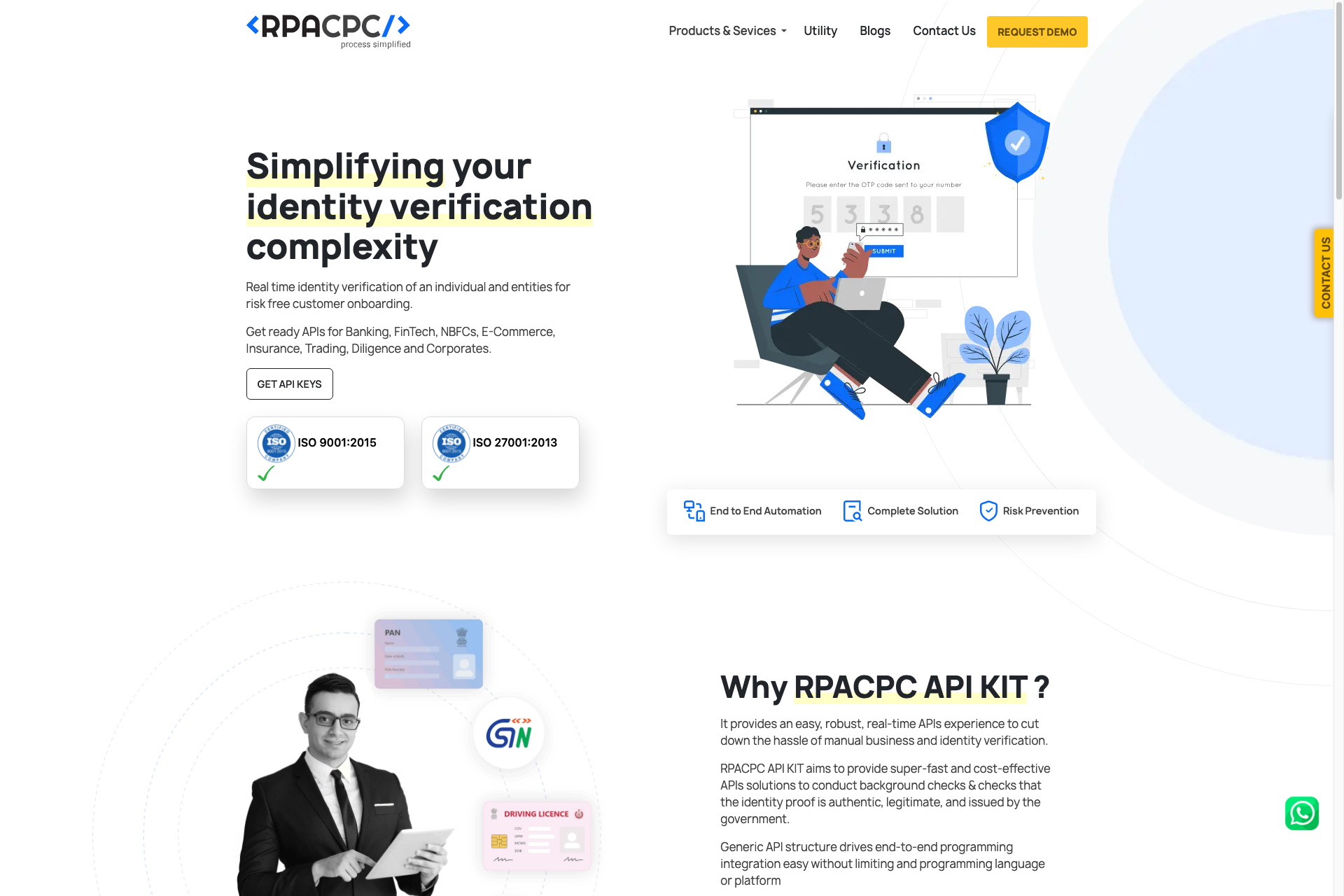

RPACPC

RPACPC offers the best identity verification solutions in India. Our solutions are efficient, accurate, & secure perfect for any business.

Related Products about RPACPC

The world's best botless meeting assistant that doesn't join calls. Instead, Shadow works locally on your device with it's seamless tech. Shadow understands conversations that are taking place and when activated, tasks are automatically completed for you.

ALIVE AI is building a new multimodal AI powered TikTok but for interactive entertainment and multiverse, a new AI native platform for the rest of us consisting of user-created interactive AI beings and open worlds.

Dream Kid writes, illustrates, and narrates children's books, weaving tales of courage, learning, and resilience to help children better understand and cope with their medical situations.

ChatApe is an AI assistant based on artificial intelligence language models, containing over 11 language models, including ChatGPT 4 and ChatGPT 4o, which can be used for AI question answering, PPT generation, mind map generation, AI translation, and more.

SpeakTrackAI: Effortless meal tracking via WhatsApp chats. Simply talk about your meals and get instant dietary insights. Stay healthy, effortlessly!

VidAU empowers you to generate videos simply through product links or descriptions, with realistic AI avatar speaking in diverse languages and accents. VidAU also offers video editing features including face swap, translation, watermark removal, and so on.