Norn

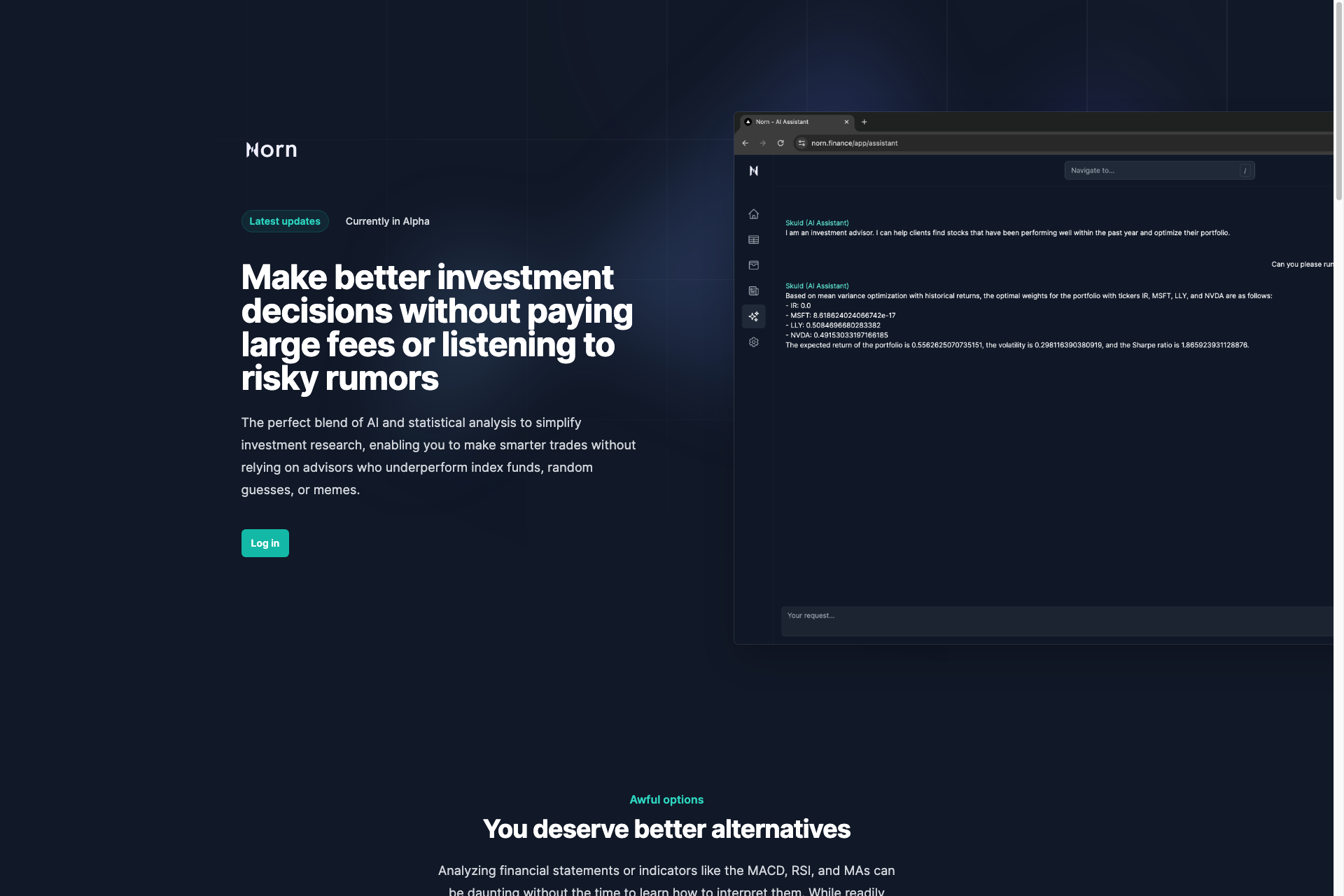

Norn combines LLMs with quantitative analysis to simplify investment research. What once required months to years of learning can now be done with prompts like 'How is MSFT doing?' or 'Help me build a portfolio with MSFT, NVDA, and LLY'.

Key Features of Norn

Automated Stock Analytics

Gain access to automated stock analytics and leverage advanced quantitative analysis for in-depth insights.

Performance Monitoring

Utilize the Sharpe Ratio to uncover investment excellence by analyzing returns and risks.

Portfolio Optimization

Achieve your financial goals with advanced optimization techniques designed to elevate your portfolio's performance.

AI Assistance

Leverage advanced Large Language Models like ChatGPT for in-depth investment research and smarter decision-making.

Next-Gen Watchlists

Experience improved tracking and analytics with managed portfolios that monitor expected return, volatility, and Sharpe ratio.

Trade Journal Companion

Track, analyze, and improve your trading strategies effortlessly with Norn's Trade Journal feature.

Frequently Asked Questions about Norn

Related Products about Norn

SAYVE revolutionizes language learning with blockchain, AI, and gaming. Earn $LINGO tokens while mastering languages in an immersive metaverse.

AIE Labs is the future of social entertainment, blending AI with blockchain to create a world of endless fun and engagement. We are currently launching 3 dApps; a NFT marketplace, a companion AI chat app, and live-streaming AI avatars all on our Layer 2 Chain.

Leveraging the power of AI, Cardamore unlocks your creativity, and enables you to give a one-of-a kind card to any person, for any occasion. Effortlessly craft bespoke cards with Cardamore.

Create documents using AI. We use Vercel's AI package, the new Novel package and more to let you create as many documents as you would like

Our startup toolkit compliments our years of experience in startup business with AI and empowers startups and investors with the resources and insights needed for success.

Histamine Alert is an AI-powered tool designed to consolidate crucial data on histamine levels, histamine liberators, and DAO enzyme effects in ingredients. It serves as an efficient search engine for histamine-related information.