CCAI

CCAI: Your AI-powered guide to navigating credit card choices. Simplifying complex terms, offering tailored advice, and answering your queries, CCAI transforms the way you understand and select credit cards, bringing financial clarity at your fingertips.

Related Products about CCAI

You love your project but coming up with good sales copies is hard and takes a lot of time? Tell Kurt about your idea and the problem you're solving and he will provide you with content that speaks to your audience, builds trust and converts.

The New Music Revolution where AI and DJs Unite! Underground DJs program the latest independent releases in electronic music and AI mixes live on air 247, with special guest DJs and manual overrides. A new creative collaboration between humans and machines. Listen live anytime for AI-mixed house, techno, downtempo. It's radio re-invented.

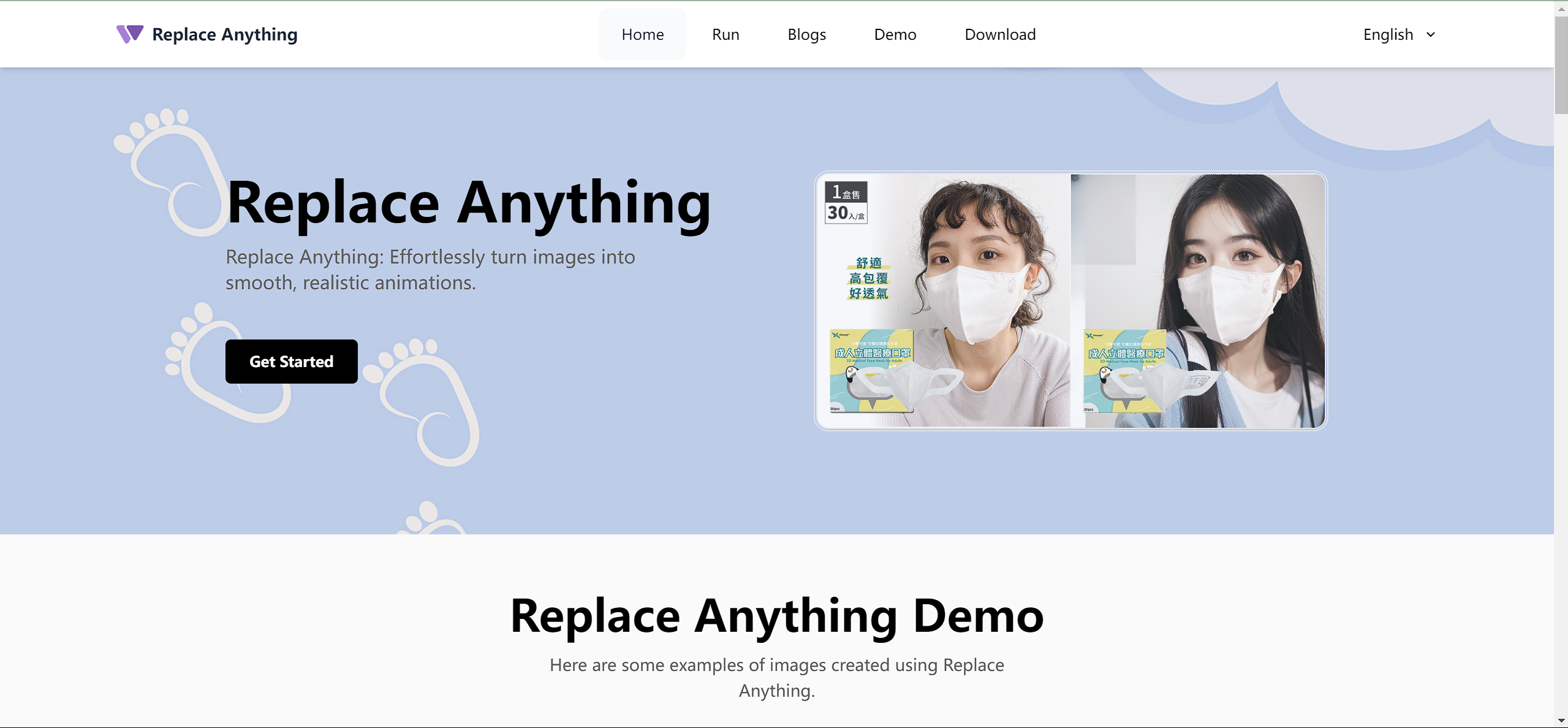

Replace Anything introduces a cutting-edge approach to content transformation, delivering unparalleled quality in replacement services.

ATalkAI is a multi model aggregation platform, which supports GPT, ERNIE Bot, Tongyi Qianwen, Doubao and other AI models, and can conduct AI online dialogue and knowledge base question and answer, and the use of ATalkAI as an AI tool is enough

Roasted With AI 🔥 uses OpenAI GPT-Vision and GPT-4 to roast your landing page and provide you with easy-win improvements based on best practices. Free tool #2/12 to be released by me (@lewisbuildsai) in 2024.

Afterword is a multi modal summarizer. It can summarize web articles, YouTube videos, even text and audio files. It's all saved in your account. You can import your Pocket saves into Afterword. It auto labels your saves into searchable categories.

ChatShelf helps ChatGPT users save conversations to Notion. It's fast, stable, beautiful, free, and offers excellent support for Notion's text formatting. 👉 Homepage: https://shelf.chat